Sales Tax Software Market - Size, Opportunities, Trends Forecast. 2029

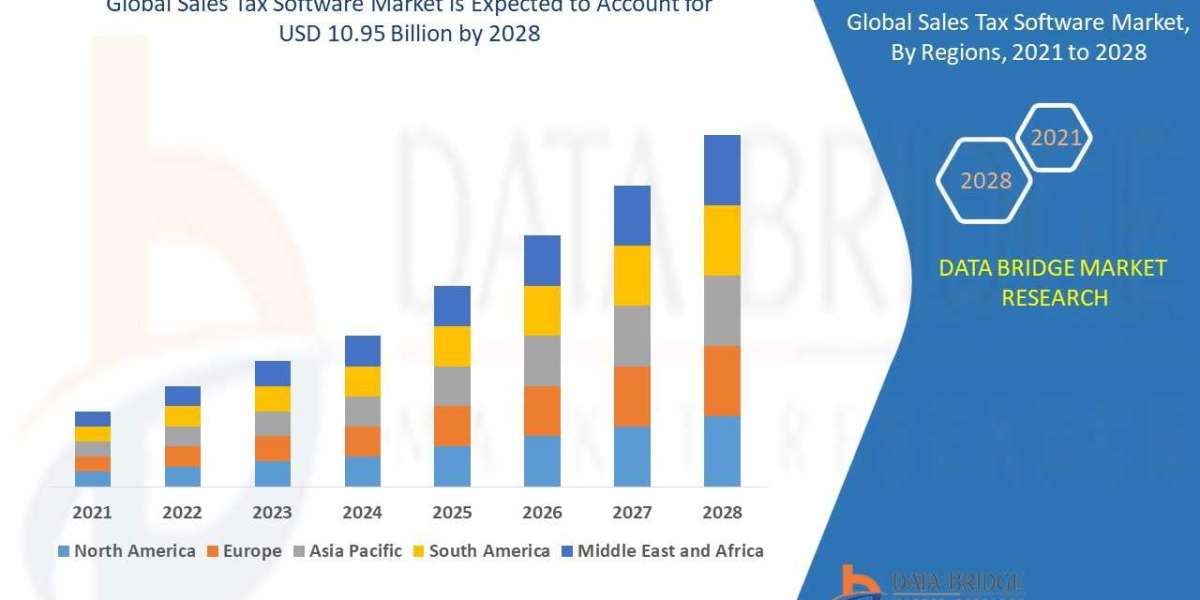

The sales tax software market will reach at an estimated value of USD 10.95 billion and grow at a CAGR of 8.05% in the forecast period of 2021 to 2028. Increase in the complications in regulations and compliances resulting in major enterprises preferring automation of tax filling is an essential factor driving the smart lecture capture market

Sales Tax Software Market segmentation

Global Sales Tax Software Market, By Solution (Consumer Use Tax Management, Automatic Tax Filings, Exemption Certificate Management, Others), Deployment Model (On-Premises, Cloud-Based, SaaS), Platform Type (Web, Mobile), Industrial Vertical (BFSI, Transportation, Retail, Telecommunication IT, Healthcare, Manufacturing, Food Services, Energy Utilities, Others), Application (Small Business, Midsize Enterprise, Large Enterprise), End-Users (Individuals, Commercial Enterprises), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2028

Request Access for free Sample Report: https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-sales-tax-software-market

Sales Tax Software Market report helps in conducting market survey for export. It collects information on marketing environment prevailing in a country and a data on consumers from different countries with which export potentials can be indicated. Market report plays a vital role in the decision-making processes by supplying relevant, up-to-date and accurate data to the decision-makers. Managers need up-to-date information to access customer needs and wants, market situation, technological change and extent of competition which can be provided by such outstanding SALES TAX SOFTWARE MARKET business report. Market research information surely helps to increase the sales.

Organizing regular market research via Sales Tax Software Market provides insight into the market, investigates spending habits of the customers, identifies existing and potential competitors, develops solution for product promotion and advertising, increases company’s recognition, improves business reputation, and so on. Market report provides company with more business planning solutions that can improve the company’s performance, improve sales and increase revenue. Through Sales Tax Software Market survey report, companies gain valuable information that helps to identify how successful product/service is likely to be, what the best price can be set for the product/service, and which customers are interested in purchasing and consuming the product/service.

Sales Tax Software Market - Scope and Market Size

The sales tax software market is segmented on the basis of solution, deployment model, industrial vertical, application and end-users. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- software market is segmented into consumer use tax management, automatic tax filings, exemption certificate management and others.

- Based on deployment model, the sales tax software market is segmented into on-premises, cloud-based and SaaS.

- Based on industrial vertical, the sales tax software market is segmented into BFSI, transportation, retail, telecommunication IT, healthcare, manufacturing, food services, energy utilities and others.

- Based on application, the sales tax software market is segmented into small business, midsize enterprise and large enterprise.

- The sales tax software market is also segmented on the basis of end-users into individuals and commercial enterprises.

Research Methodology:

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

Sales Tax Software Market Industry Country-Level Industry Analysis

The countries covered in the Sales Tax Software Market report are:

- S., Canada and Mexico in North America

- , Brazil, Argentina and Rest of South America as part of South America,

- Germany, Italy, U.K., France, Spain,

- Netherlands, Belgium, Switzerland,

- Turkey, Russia, Rest of Europe in Europe,

- Japan, China, India, South Korea, Australia,

- Singapore, Malaysia, Thailand, Indonesia,

- Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia,

- A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

Sales Tax Software Market - Some major players

The major players covered in the pea flour market report

- APEX Analytix, LLC; Avalara Inc.;

- ; Intuit Inc.; LumaTax, Inc.;

- Ryan, LLC; Sage Intacct, Inc.; Sales Tax DataLINK;

- Sovos Compliance, LLC; Thomson Reuters; Vertex, Inc.;

- Zoho Corporation Pvt. Ltd.; Xero Limited;

- The Federal Tax Authority, LLC d/b/a TaxCloud; Wolters Kluwer;

- CFS Tax Software Inc.; Service Objects, Inc.; TaxJar;

- Chetu Inc. and HRB Digital LLC among other domestic and global players.

- Market share data is available for global, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South America separately.

Access Full Report : https://www.databridgemarketresearch.com/reports/global-sales-tax-software-market

Major TOC of the Digital Out of Home Advertising Report

- Chapter One: Introduction

- Chapter Two: Market Segmentation

- Chapter Three: Market Overview

- Chapter Four: Executive Summary

- Chapter Five: Premium Insights

- Chapter Six: Sales Tax Software Market

Get TOC of the Report : https://www.databridgemarketresearch.com/toc/?dbmr=global-sales-tax-software-market

Browse Related Reports @

- Global Operational Technology Endpoint Security Market

- Global Wearable Conferencing Technology Market

- North America Wearable Conferencing Technology market

- Middle East and Africa Wearable Conferencing Technology Market

- Europe Wearable Conferencing Technology market

FREQUENTLY ASKED QUESTIONS

- At what growth rate will the market be projected to grow during the forecast period of 2021 to 2028?

- What will be the market value in the future?

- Who are the major players operating in the market?

- Which countries data are covered in the report?

About Us:

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market

Contact:

- Data Bridge Market Research

- Tel: +1-888-387-2818

- Email: [email protected]