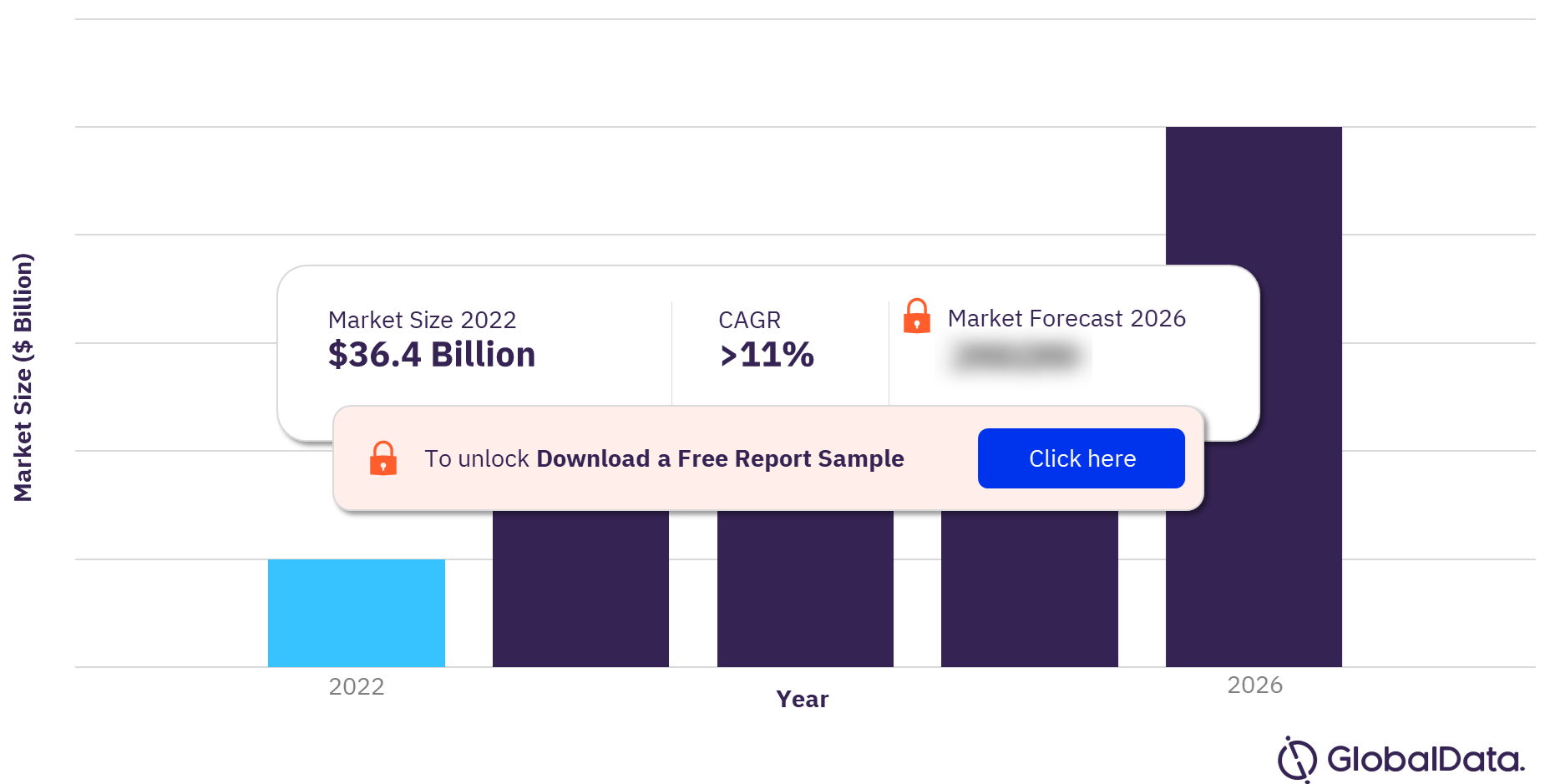

The Vietnam cards and payments market size was valued at $36.4 billion in 2022 and is expected to achieve a CAGR of more than 11% during 2022-2026. Cash dominates the payment market in Vietnam owing to the highly unbanked population, limited financial awareness among consumers, and inadequate payment infrastructure. However, the government along with the State Bank of Vietnam (SBV) and other regulatory authorities is taking several initiatives to boost non-cash payments.

The Vietnam cards and payments market research report provides a detailed analysis of market trends in the Vietnamese cards and payments industry. The report provides values and volumes for several key performance indicators in the industry, including cards, direct debits, credit transfers, and cheques during the review period. It also analyzes various payment card markets operating in the industry and provides detailed information on the number of cards in circulation, transaction values, and volumes during the review period and over the forecast period. Moreover, it offers information on the country’s competitive landscape, including market shares of issuers and schemes.

To gain more information on the Vietnam cards and payments market forecast, download a free report sample

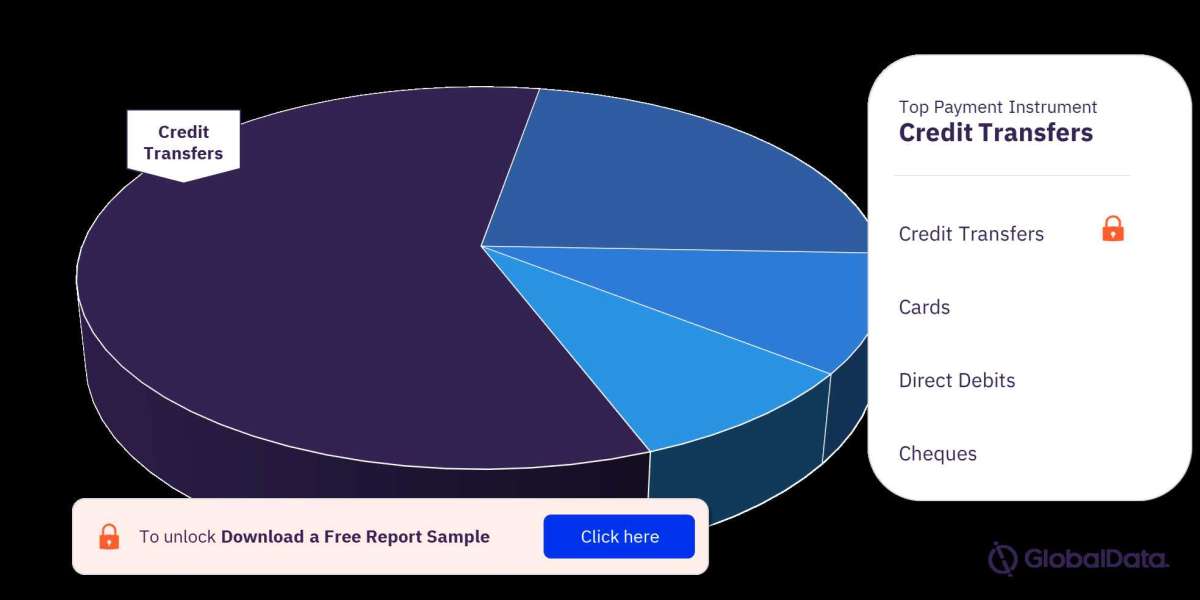

Alternative payments are gaining prominence in the country, with several international and domestic payment methods being offered. Most recently, Google Wallet was launched in the country to allow users to make in-store, online, and in-app payments. In addition to payments, Google Wallet enables users to store cards, tickets, passes, keys, and IDs. Google Wallet has been launched for Visa cardholders in Vietnam and is supported by ACB, Sacombank, Shinhan Bank, Techcombank, TPBank, Vietcombank, and VPBank. The key payment instruments in the Vietnam cards and payments market are cards, credit transfers, direct debits, and cheques. In 2022, credit transfer was the major payment instrument followed by cards and direct debits.