Explore the thriving landscape of UK pet insurance in the United Kingdom. This comprehensive analysis provides valuable insights into the latest trends, key players, and consumer preferences shaping the pet insurance industry. Dive into coverage options, emerging technologies, and the evolving regulatory landscape. From established providers to niche offerings, uncover the strategies that are propelling the UK pet insurance market forward in this competitive space.

For more channel insights into the UK pet insurance market, download a free report sample

The United Kingdom (UK) pet insurance market research report explores how purchasing preferences have changed over time in the UK pet insurance market. It discovers what is most influential to customers when purchasing a pet insurance policy and reveals the most popular providers in the market. New trends and innovations are highlighted as well as the key factors that will influence the market over the next few years.

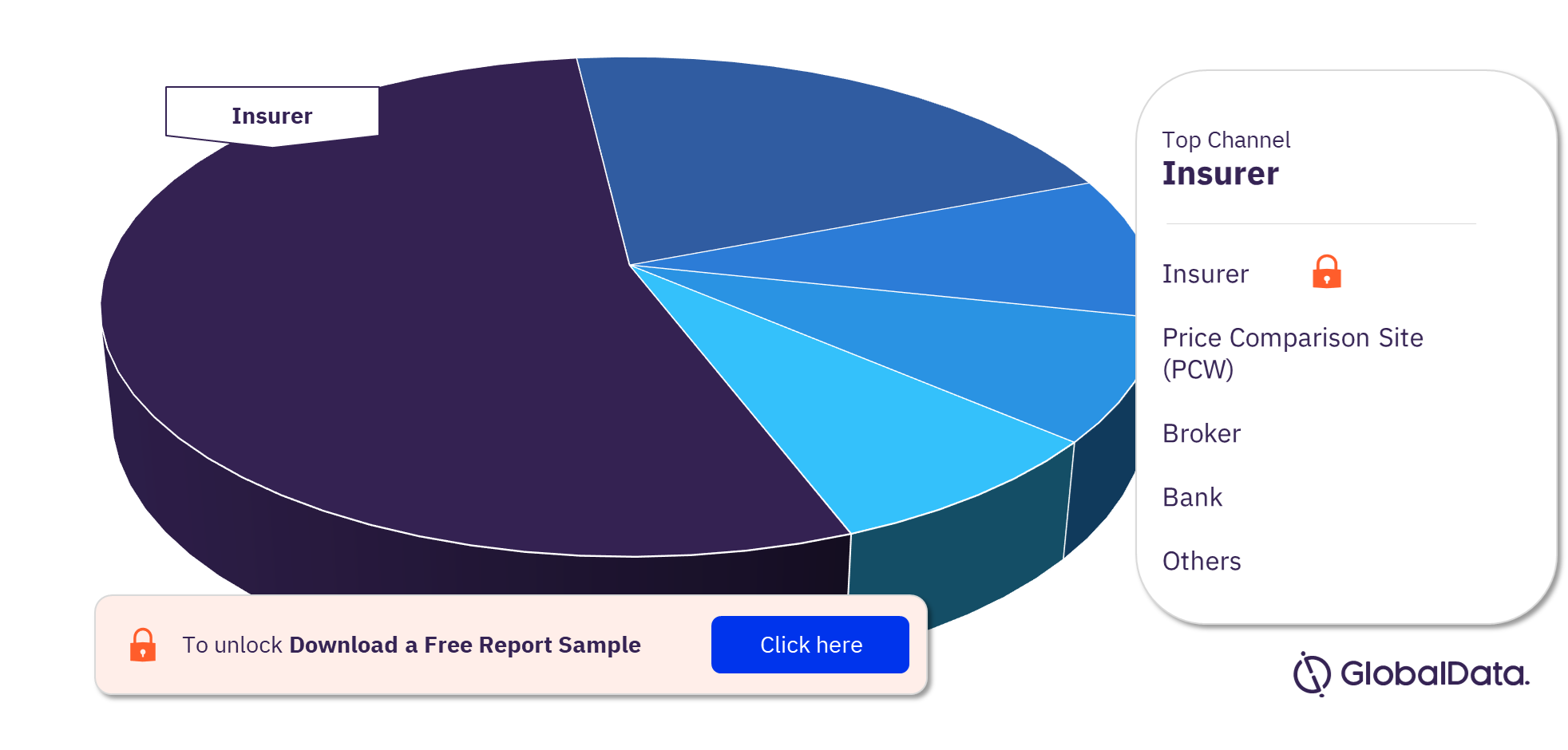

The key channels in the UK pet insurance market are insurers, price comparison sites (PCW), brokers, banks, and affinity, among others. Insurers and PCWs were the top two channels in 2022.

Insurers have an untapped opportunity to increase their online presence by offering additional services and benefits to pet owners. They should develop platforms that can be easily accessible to consumers while tracking their pets frequently. Moreover, they can provide premium discounts based on the pet’s activity.